When trading in the foreign exchange market, part of the process involves forecasting future price movements in order to determine the best time to buy and sell. One method, called technical analysis, takes a look at the market’s past price movements to determine where the numbers will go in the future. Most investors who employ this type of analysis look mostly at price data, but sometimes information such as volume and open interest in futures contracts are also taken into consideration. If you’re just starting out in forex, the rule of thumb is to keep your methods simple - follow the basics, which have been proven over time, and only when you have gained some experience introduce more difficult techniques into your plans.

Technical analysis is almost always used on some level because price charts provide a good visual representation of the price history of a particular currency. At the very least, they can help you determine ideal entry and exit points for a trade based on the historical data. You can decide whether or not you’re buying at a fair price, selling at the top of a cycle, or entering into a shaky market.

It may seem as if adherents of technical analysis disregard market fundamentals in favor of mounds of charts and data, but they argue that these fundamentals are ingrained in the actual numbers. Something unpredictable may cause the numbers to unexpectedly spike, but you can still analyze the data, and identify patterns that will aid you in forecasting future prices.

Essentially, technical analysis can be summed up in three points. First of all, as mentioned above, technical traders assume that market fundamentals are tied to the price data. This is why factors such as the fear, hope, and mood of market participants are not contemplated directly.

Secondly, the idea that history repeats itself is core to this system of analysis. It is possible to look for patterns in price movement (called signals) because the market is predictable. When you look at past market signals you should be able to predict future signals.

Lastly, technicians rely on trends. From this analytical perspective, the market is not irregular or unpredictable. Rather, you can determine, to a high degree of accuracy, what direction a price will take: up, down, or sideways. In addition, trends are expected to continue for a period of time, making it possible to formulate predictions.

But it’s important to understand that technical analysts use more than price charts to determine good entry and exit points. Price charts are used in conjunction with volume charts, and other mathematical representations of market signals. Called studies, these additional pieces of information add another layer of data to the analysis. They let the trader look at the strength and sustainability of trends, in addition to the bare statistics.

Technical analysis is, of course, quite complicated - but for the new trader just starting out in forex, following the basics is a good place to begin. After you gain some experience and learn more about the foreign exchange market, you can delve into more complex research strategies.

Article Source: kokkada.com

See also:

How To Use MACD

Easy-Forex? The best trading platform available today.

Forex Trading Explained

Institutional Forex System

The MasterTrader eBook

Forex Profits

Wednesday, September 20, 2006

Friday, September 08, 2006

Short Term Analysis - September 8, 2006

AUDUSD

Key support at 0.7626 is broken below, AUDUSD will fall towards 0.7550 to reach the next cycle bottom. If 0.7550 support gives way, further fall towards 0.7400 area is possible in the next one or two weeks.

EURUSD

EURUSD fell below the support at 0.2725, further fall towards 1.2650 area to reach the next cycle bottom is possible in the next several days. Key resistance is now at 1.2830, break above this level may signal the cycle bottom.

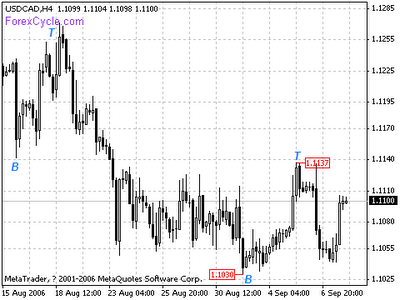

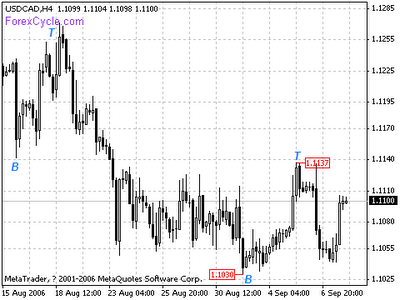

USDCAD

USDCAD rebound from the support at 1.1030. It is forming a sideways consolidation on 4 hours chart. Key resistance is at 1.1137, a break above this level may signal the cycle bottom at 1.1030. On the other side, if near term support at 1.1030 gives way, the pair would fall towards 1.0950.

GBPUSD

GBPUSD fall below the key support at 1.8793, further fall towards 1.8600 area to reach the next cycle bottom is still possible in the next several days. Key resistance is at 1.8955, only break above this level may signal the reversal to the down trend.

USDJPY

USDJPY stay in the rising price channel. Further rise above 117.49 is possible in the next several days. Key support is at 115.57, as long as this support holds, up trend will continue.

USDCHF

USDCHF rose above 1.2444. Further rise towards 1.2500 area is still possible later today. Key support is at 1.2326, only break below this level may signal the reversal to the up trend.

-------

Our server downed. We post the Short Term Analysis here temporary.

Franco

ForexCycle.com

Key support at 0.7626 is broken below, AUDUSD will fall towards 0.7550 to reach the next cycle bottom. If 0.7550 support gives way, further fall towards 0.7400 area is possible in the next one or two weeks.

EURUSD

EURUSD fell below the support at 0.2725, further fall towards 1.2650 area to reach the next cycle bottom is possible in the next several days. Key resistance is now at 1.2830, break above this level may signal the cycle bottom.

USDCAD

USDCAD rebound from the support at 1.1030. It is forming a sideways consolidation on 4 hours chart. Key resistance is at 1.1137, a break above this level may signal the cycle bottom at 1.1030. On the other side, if near term support at 1.1030 gives way, the pair would fall towards 1.0950.

GBPUSD

GBPUSD fall below the key support at 1.8793, further fall towards 1.8600 area to reach the next cycle bottom is still possible in the next several days. Key resistance is at 1.8955, only break above this level may signal the reversal to the down trend.

USDJPY

USDJPY stay in the rising price channel. Further rise above 117.49 is possible in the next several days. Key support is at 115.57, as long as this support holds, up trend will continue.

USDCHF

USDCHF rose above 1.2444. Further rise towards 1.2500 area is still possible later today. Key support is at 1.2326, only break below this level may signal the reversal to the up trend.

-------

Our server downed. We post the Short Term Analysis here temporary.

Franco

ForexCycle.com

Monday, September 04, 2006

How to stop loss

Using Stop Loss in anytime we enter the market is one way to manage our risk in trading. While some other traders might consider it as the sissy way, I don't….. I like to trade using Stop Loss. And it brings me to good results in the end of the day. Keeps me stick with well-controlled trading system.

When we decide to use stop loss, then we must be discipline in implementing it. If market price is heading so close to our stop loss, then we must not do anything. Do not ever try to replace your stop loss at further level from your open position level.

Replace your stop loss only for one reason:

For Trailing Stop Strategy (although I hardly ever use trailing stop strategy).

Now the problem is… where should we put our stop loss in each trading? Here are some tips I could give you:

1. Measure the gap between your stop loss and your open position level.

Usually I use these rules:

Eur/Usd: gap between stop loss and open position = 35 pips

Gbp/Usd: gap between stop loss and open position = 50 pips

These are representing maximum losses that you could handle in each trade. Keep that always in mind. We're not going to enter the market without this gap rule.

2. Entry strategy

Then you could predict your best entry level using your trading system. And when you decide to enter the market at certain level (using your trading strategy), do not forget to pay attention to your stop loss. Where will your stop loss be placed using the gap rule on tips #1.

Try to put your stop loss below Support Level (for Long position) or above Resistance Level (for short position).

For example:

We had Eur/Usd support and resistance levels are at:

R3 1.3052

R2 1.2962

R1 1.2906

Pivot 1.2816

S1 1.2760

S2 1.2670

S3 1.2614

Then after measuring the trend, you noticed that 1.2870 is the best place to short on eur/usd. That means, by using 35 gaps rule (see point#1), your Stop Loss would be at 1.2905.

Unfortunately, 1.2905 is not a good level to place your Stop Loss. Why? It is not protected by resistance level. When market moves upward, your Stop Loss is not well protected by its technical factor. So it would be quite easy for the market to hit your Stop Loss. Nearest resistance is 1.2906, above 1.2905. So what do we do here is to move our Stop Loss a little above 1.2905. Let's say we move it to 1.2910. Now technically, you have a well protected stop loss.

When you move Stop Loss, do not forget about the gap rule (as said in point#1). So we have to move also our open position plan.

And now, your plan becomes Short at 1.2875 (5 pips above 1.2870) and Stop Loss at 1.2910 (5 pips above 1.2905).

3. Keep calm when market heading so close to your stop loss.

Anything could happen in Forex in very short time. No one can control people madness when they enter the market. But the most important thing in dealing with this mad world is 'risk management'. Successful traders realize that sometimes they had to deal with fail trades.

So if your stop loss is hit, let it go. That's just the way it is.

Article Source: kokkada.com

See also:

How To Use MACD

Easy-Forex? The best trading platform available today.

Forex Trading Explained

Institutional Forex System

The MasterTrader eBook

Forex Profits

When we decide to use stop loss, then we must be discipline in implementing it. If market price is heading so close to our stop loss, then we must not do anything. Do not ever try to replace your stop loss at further level from your open position level.

Replace your stop loss only for one reason:

For Trailing Stop Strategy (although I hardly ever use trailing stop strategy).

Now the problem is… where should we put our stop loss in each trading? Here are some tips I could give you:

1. Measure the gap between your stop loss and your open position level.

Usually I use these rules:

Eur/Usd: gap between stop loss and open position = 35 pips

Gbp/Usd: gap between stop loss and open position = 50 pips

These are representing maximum losses that you could handle in each trade. Keep that always in mind. We're not going to enter the market without this gap rule.

2. Entry strategy

Then you could predict your best entry level using your trading system. And when you decide to enter the market at certain level (using your trading strategy), do not forget to pay attention to your stop loss. Where will your stop loss be placed using the gap rule on tips #1.

Try to put your stop loss below Support Level (for Long position) or above Resistance Level (for short position).

For example:

We had Eur/Usd support and resistance levels are at:

R3 1.3052

R2 1.2962

R1 1.2906

Pivot 1.2816

S1 1.2760

S2 1.2670

S3 1.2614

Then after measuring the trend, you noticed that 1.2870 is the best place to short on eur/usd. That means, by using 35 gaps rule (see point#1), your Stop Loss would be at 1.2905.

Unfortunately, 1.2905 is not a good level to place your Stop Loss. Why? It is not protected by resistance level. When market moves upward, your Stop Loss is not well protected by its technical factor. So it would be quite easy for the market to hit your Stop Loss. Nearest resistance is 1.2906, above 1.2905. So what do we do here is to move our Stop Loss a little above 1.2905. Let's say we move it to 1.2910. Now technically, you have a well protected stop loss.

When you move Stop Loss, do not forget about the gap rule (as said in point#1). So we have to move also our open position plan.

And now, your plan becomes Short at 1.2875 (5 pips above 1.2870) and Stop Loss at 1.2910 (5 pips above 1.2905).

3. Keep calm when market heading so close to your stop loss.

Anything could happen in Forex in very short time. No one can control people madness when they enter the market. But the most important thing in dealing with this mad world is 'risk management'. Successful traders realize that sometimes they had to deal with fail trades.

So if your stop loss is hit, let it go. That's just the way it is.

Article Source: kokkada.com

See also:

How To Use MACD

Easy-Forex? The best trading platform available today.

Forex Trading Explained

Institutional Forex System

The MasterTrader eBook

Forex Profits

Subscribe to:

Posts (Atom)