Tuesday, August 29, 2006

Head and shoulders appears in the GBPUSD chart

Thursday, August 24, 2006

How To Use MACD

The No.1 (and Only) Reason To Hate Technical Indicators

I often hate technical studies because they divert my attention from what's most important – PRICE.

Have you ever been to a magic show? Isn't it amazing how magicians pull rabbits out of hats and make all those things disappear? Of course, the "amazing" is only possible because you're looking at one hand when you should be watching the other. Magicians succeed at performing their tricks to the extent that they succeed at diverting your attention.

That's why I hate technical indicators; they dived my attention the same way magicians do Nevertheless, I have found a way to live with them, and I do use them Here's how: Rather than using technical indicators as a means to gauge momentum or pick tops and bottoms, I use them to identify potential trade setups.

Three Reasons To Learn To Love Technical Indicators

Out of the hundreds of technical indicators I have worked with over the years, my favorite study is MACD (an acronym for Moving Average Convergence-Divergence) MACD, which was developed by Gerald Appel, uses two exponential moving averages (12-period and 26-period). The difference between these two moving averages is the MACD line. The trigger or Signal line is a 9-period exponential moving average of the MACD line (usually seen as 12/26/9…so don't misinterpret it as a date) Even though the standard settings for MACD are 12/26/9, I like to use 12/25/9 (it's just me being different). An example of MACD is shown in Figure 10-1 (Coffee).

The simplest trading rule for MACD is to buy when the Signal line (the thin line) crosses above the MACD line (the thick line), and sell when the Signal line crosses below the MACD line Some charting systems (like Genesis or CQG) may refer to the Signal line as MACD and the MACD line as MACDA Figure 10-2 (Coffee) highlights the buy-and-sell signals generated Item this very basic interpretation.

Although many people use MACD this way, I choose not to, primarily because MACD is a t rend-following or momentum indicator. An indicator that follows trends in a sideways market (which some say is the state of markets 80% of time) will get you killed For that reason, I like to locus on different information that I've observed and named: Hooks, Slingshots and Zero-Line Reversals Once I explain these, you'll understand why I've learned to love technical indicators.

Hooks

A Hook occurs when the Signal line penetrates, or attempts to penetrate, the MACD line and then reverses at the last moment. An example era Hook is illustrated in Figure 10-3 (Coffee).

I like Hooks because they fit my personality as a trader. As I have mentioned before. I like to buy pullbacks in uptrends and sell bounces in downtrends. And Hooks do just that - they identify countertrend moves within trending markets.

In addition to identifying potential trade setups, you can also use Hooks as confirmation. Rather than entering a position on a cross-over between the Signal line and MACD line, wait for a Hook to occur to provide confirmation that a trend change has indeed occurred Doing so increases your confidence in the signal, because now you have two pieces of information in agreement.

Figure 10-4 (Live Cattle) illustrates exactly what I want this indicator to do: alert me to the possibility of rejoining the trend In Figure 10-5 (Soybeans), I highlight two instances where the Hook technique worked and two where it didn't.

But is it really fair to say that the signal didn't work? Probably not, because a Hook should really just be a big red flag, saying that the larger trend may be ready to resume. It's not a trading system that I blindly follow All I'm looking for is a heads-up that the larger trend is possibly resuming. From that point on, I am comfortable making my own trading decisions. If you use it simply as an alert mechanism, it does work 100% of the time.

Slingshots

Another pattern I look for when using MACD is called a Slingshot. To get a mental picture of this indicator pattern, think the opposite of divergence. Divergence occurs when prices move in one direction (up or down) and an indicator based on those prices moves in the opposite direction.

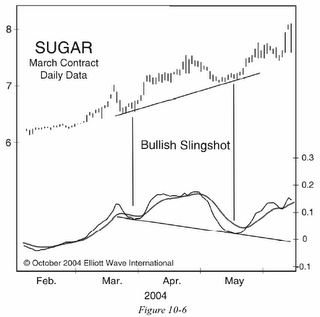

A bullish Slingshot occurs when the current swing low is above a previous swing low (swing lows or highs are simply previous extremes in price), while the corresponding readings in MACD are just the opposite Notice in Figure 10-6 (Sugar) how the May low was above the late March swing low However, in May, the MACD reading tell below the level that occurred in March. This is a bullish Slingshot, which usually identifies a market that is about to make a sizable move to the upside (which Sugar did).

A bearish Slingshot is just the opposite: Prices make a lower swing high than the previous swing high, but the corresponding extreme in MACD is above the previous extreme Figure 10-7 (Soybeans) shows an example era bearish Slingshot.

Zero-Line Reversals

The final trade setup that MACD provides me with is something I call a Zero-Line Reversal (ZLR). A Zero-Line Reversal occurs when either the Signal line or the MACD line Falls (or rallies) to near zero, and then reverses It's similar in concept to the hook technique described above The difference is that instead of looking for the Signal line to reverse near the MACD line, you're looking for reversals in either the Signal line or the MACD line near zero. Let's look at some examples of Zero-Line Reversals and I'm sure you'll see what I mean.

In Figure 10-8 (Sugar), you can see two Zero-Line Reversals Each time, MACD reversed above the zero-line, which means they were both bullish signals When a Zero-Line Reversal occurs from below, it's bearish. Figure 10-9 (Soybeans) shows an example of one bullish ZLR from above, and three bearish reversals from below. If you recall what happened with Soybeans in September 2005, the bearish ZLR that occurred early that month was part of our bearish Slingshot from Figure 10-7 These combined signals were a great indication that the August advance was merely a correction within the larger sell-off that began in April That meant that lower prices were forthcoming, as forecast in tile August and September issues of Monthly Futures Junctures.

So there you have it, a quick rundown on how I use MACD to alert me to potential trading opportunities (which I love) Rather than using MACD as a mechanical buy-sell system or using it to identify strength or weakness in a market, I use MACD to help me spot trades And the Hook, Sling-shot and Zero-Line Reversal are just a few trade setups that MACD of offers.

Article Source: elliottwave.com

Tuesday, August 22, 2006

Why trading diary is important to improve your forex trading

Do you have a habit to write trading diaries? I think it's important for a trader to write down their trading records. Most traders spend all their time for searching news of the market, looking at the charts they planning to trade. Of course, all of these are important for your trading. Recording your trading transactions is just as important.

Traders always lost himself in mass of trading records. What currency pair did you trade? Why did you place these orders? Are all of these trading decisions according to your strategies, if you really have some? In order to answer all of these questions, mark up all your trading records in a diary.

What should it contain?

- Currency pairs

- Buy/sell date and price

- profit/loss

- Entry strategy

- Exit Strategy

- Comments

Tuesday, August 15, 2006

Timing Is Everything

So is success down to luck - well yes and no. I'm a big believer in creating your own luck. If you put yourself about, take risks (albeit calculated ones) and put yourself in situations where opportunity can be seized.

The most common piece of investment advice given is 'get into property' and as a general rule it's sound advice. Property in general appreciates in value over time and delivers a return on investment significantly better than any bank or savings scheme can offer. However - timing can make or break the investment opportunity. Many have been caught short by entering the property market at the wrong time and making very little - and in some sad cases ending up in negative equity. If you buy in a town that is on the rise - then you'll make money from your investment. If you buy in town and a factory then lays of 1,000 employees causing widespread unemployment - there's a good chance that you could lose money, see very little growth or have to wait a long time to see a return on your investment.

If I could give only one piece of investment advice it would be to develop the skill of being able to spot opportunities. Broaden your perspective – think laterally and learn how to read how events will shape things financially and then make calculated decisions based on those factors. If you can learn this new kind of thinking – then you will see investment opportunities others miss – and most importantly you will see them in time to get in early.

For a prime example of a time sensitive online investment opportunity that will give you a fantastic return on investment go to http://online-investment-secrets.com.

Article Source: kokkada.com

Monday, August 14, 2006

How To Handle A String Of Investment Losses

Everybody hates to lose and unfortunately no one is blessed with the ability of foresight, therefore losses are an unavoidable part of trading. When we enter a trade we will either be right, or wrong, and even if we broke-even we'd still be classed as being wrong - as nobody enters into a trade just to break-even! When unsuccessful traders encounter a string of losses they begin to engage in self-destructive patterns that help them escape the pain they are experiencing.

Bring to light these self-destructive actions that can help you realize what you are doing before it takes hold of your physical health. If you find yourself already engaged in these patterns hopefully this article can help you to get you back on track as quickly as possible.

What are the destructive patterns?

If you find yourself caught in a string of losses or a bad performing week/month be sure to monitor your behavior. It is during this time that you will be at your most vulnerable. You will begin to indulge in activities that at first seem harmless, but upon excessive use (or in time), begin to cause physical damage to your health.

Ask yourself the following question: during drawdown periods do I find myself over-indulging in these activities:

Food (especially junk food - e.g. chocolate, ice-cream, chips)?

Sex (includes viewing pornography)?

Alcohol?

Drugs (includes excessive smoking)?

Laziness (find it difficult to wake up in the morning)?

Entertainment?

All of the above taken in excessive doses can be detrimental to your own physical health (some even in small doses!).

These activities above during your losing period are only covering up the pain of confronting the true issue, and your body tries to rid the emotional pain by trying to "fix" it with physical pleasures. Unfortunately it is going about it in the wrong way, so what should you do?

Firstly... REALIZE WHAT YOU ARE DOING AND STOP IT!

You need to realize what you're doing and you need to STOP doing it immediately! You can either decide to stop, or you'll be forced to stop when your body eventually breaks down and prevents you from any form of movement. It will be much more beneficial to you in the long-term if you can decide to stop *NOW*.

Once you have stopped you now need to figure out a way to solve the pain - not by cutting out or neglecting it, but by staring it in the face. Bring your problems out into the light, be honest with yourself. There can be no growth without pain; you are experiencing the emotional pain, now it is time to find the error and therefore your growth.

Begin Your Review

The review process begins in two separate areas: You & Your System. Here are some checklists for you to go through to find out where the problem could lie:

"YOUR SYSTEM" CHECKLIST

Was your system thoroughly tested prior to trading it (or paper traded if you do not have the capacity to program your system into back testing software)?

Did you test with out-of-sample data?

Do you even have a system???? If you do not, how do you even know if the method that you are trading is even profitable??

Is your system's code correct?

Did you over-optimize your system? (What have we discussed about over-indulging?)

Did you paper trade your system prior to placing capital on it?

Did you trade with a small amount of capital prior to placing the rest of your funds on it?

Do you know the system's limitations?

Did you properly drill your system? (See our blog article on why I am the system designer from hell)

"YOU" CHECKLIST

Is the current drawdown you are exhibiting with your system normal?

Are you comfortable with your system's historical drawdown performance?

Are you fully aware of the risks involved with your system and the instrument(s) you are trading?

Are you trading with funds that you are comfortable risking?

Are you relying too heavily on your performance?

Have you set realistic goals?

As you can see there are generally two areas that you need to explore: the mechanical aspect - your system - and the emotional aspect - you. Both can be responsible for making the way you feel the way you do. It will either be an error on the system's side with how the system was tested and/or programmed, or it can be your own psychological profile not being comfortable with the system's performance.

Your Answers = Change = Your Growth

What steps should we now take? Now that we have begun a corrective process where we have stopped the evil nature of our over-indulging ways to take control we should continue our "corrective nature" by invoking our findings and taking ACTION in correcting our errors.

If the problem was mechanical - fix it, if the problem was emotional either go about setting up new thought patterns, or change your current system. The answers lie in whether you need to expand your knowledge in system development, or whether you need to grow emotionally as a person.

Unfortunately there is no easy road, and even if there was everybody would be doing it. Hopefully this article has made you ponder over some of your behaviors during drawdown periods, be sure to keep an eye on yourself and as always take care of your body, because there's no use in making all the money in the world when you don't have the physical capacity to enjoy it

Article Source: kokkada.com

Sunday, August 13, 2006

Don’t Loose Money, Invest In Forex Accounts

Have you lost money because your local currency depreciated against major currencies?I believe you should try investing in forex accounts.

A Forex Trading Managed Account (or, hedging fund account) is the investment vehicle that beats devaluation far more than traditional portfolios. A Forex Managed Account is an investment portfolio, privately owned by an individual or institution, but managed professionally by experienced traders in the global currency market.

Here are a few advantages of a forex managed account:

You also have access to check the activity of your account 24 hours around the clock showing you the net value via internet.

You are not affected by the declining value (prices) of any of the currencies your trader will invest in.

You earn above average returns on your investment.

Your funds are kept in a world-wide accepted convertible currency at a first class bank.

You are the only person having access to your account.

Due to all these reasons, I believe that investment portfolios are an excellent foreign exchange generating opportunity for developing countries.